Flood Insurance

When waters rise, flood insurance can be a real lifesaver, especially since regular home insurance doesn't cover flood damage. Flood coverage is critical whether or not your home is in an area recognized as high risk on the Federal Emergency Management Agency’s (FEMA) flood maps. Having flood insurance can give you peace of mind and protect your home and belongings.

Why Flood Insurance Matters

Flooding can happen anywhere, whether from hurricanes, storm surges, or even heavy rains. Just an inch of water in your home can cause thousands of dollars in damage, and recovery without insurance can be financially devastating. Flood insurance helps bridge that gap, offering peace of mind and ensuring you’re covered when the unexpected happens.

Types of Flood Insurance Coverage

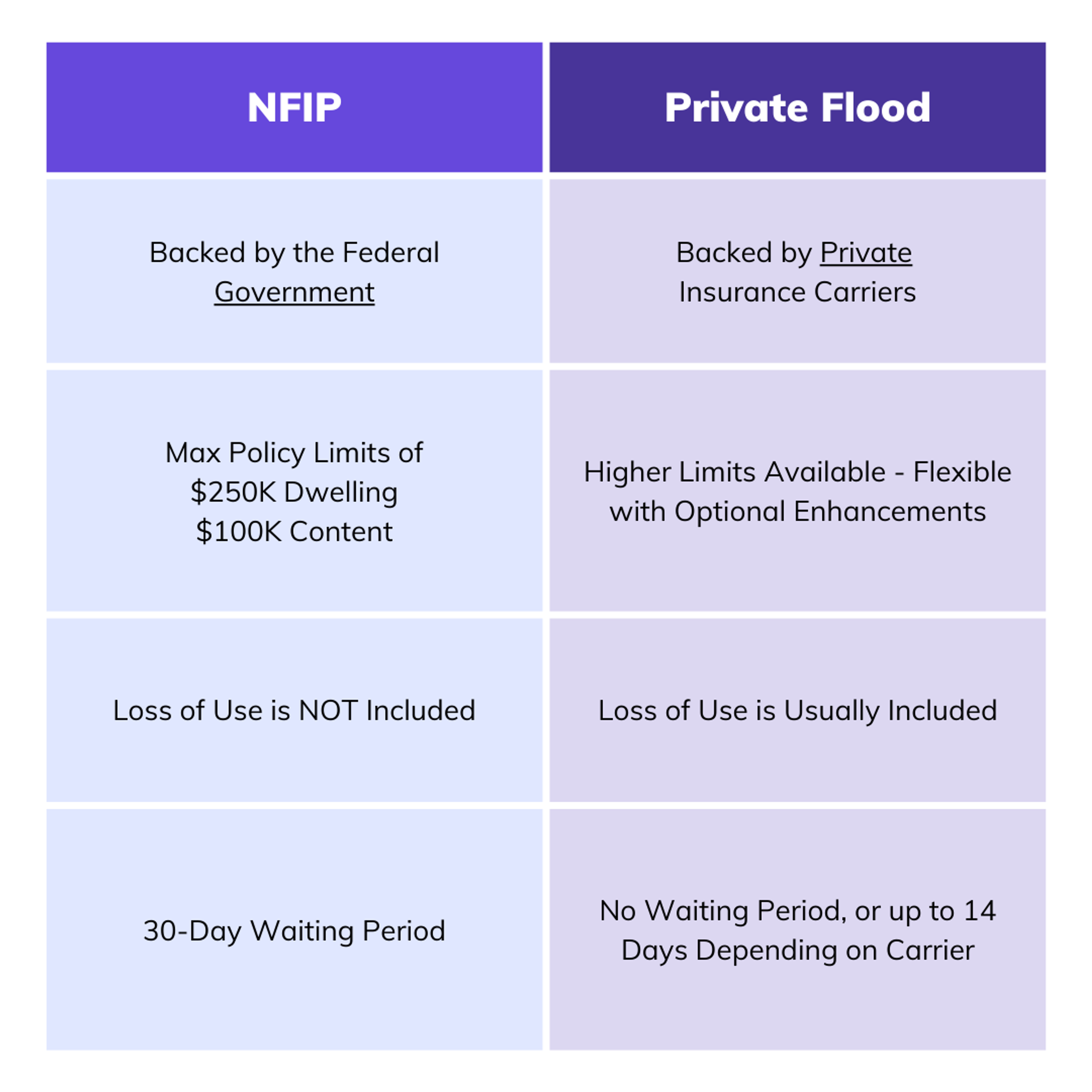

National Flood Insurance Program (NFIP): Backed by FEMA, the NFIP is a government-provided option for flood insurance. It offers basic coverage for property damage up to $250,000 for the structure and $100,000 for personal belongings. However, the coverage options are often limited, and additional features like living expenses aren’t included.

Private Flood Insurance: Private insurers offer more flexible policies that can provide higher coverage limits and additional benefits, like temporary housing costs and personal property replacement. Private flood insurance is ideal for homeowners looking for a more tailored approach, often at competitive rates.

Frequently Asked Questions

Q: What’s the main difference between NFIP and private flood insurance?

A: The NFIP is a federal program managed by FEMA, while private flood insurance is offered by independent insurance carriers. Unlike NFIP, private carriers can provide more flexible coverage limits and may include extra benefits, like additional living expenses, that the NFIP doesn’t cover.

Q: What are some advantages of an NFIP flood policy vs a private flood policy?

A: NFIP flood insurance offers guaranteed access, meaning that even if you live in a high-risk flood zone, the NFIP must provide coverage to anyone in a participating community. Private insurers might not offer coverage in certain areas or to certain properties due to high risk.

The NFIP also does not deny based on risks. Private insurers might choose not to renew your policy if you file too many claims, but the NFIP cannot deny coverage based on past claims.

Q: What is the biggest advantage of private flood insurance?

A: With private flood insurance, the insurance company takes on the risk and can tailor policies, often offering broader coverage than the NFIP.

Q: Isn’t all flood insurance through the NFIP anyway?

A: Not anymore. While the NFIP used to dominate the market, private carriers now offer competitive options. Many provide higher coverage limits, extra features, and sometimes lower rates. To ensure you get the best value, request a quote using our flood quoting tool and evaluate all your options. Your licensed HomeFront agent can help you explore both NFIP and private flood insurance to find the right fit for your situation.

Q: Do lenders accept private flood insurance?

A: Yes, they do. Thanks to the Biggert-Waters Act, lenders must accept private flood insurance that meets specific legal definitions and purchase requirements.

Q: Is private flood insurance cheaper than the NFIP?

A: It depends on many factors. Your flood zone, elevation, and proximity to water all play into the price of flood coverage. The best approach is to get a quote from multiple carriers and weigh your options. A licensed HomeFront agent is here to help you find the most cost-effective solution for your specific needs.

How to Choose the Right Flood Insurance

Choosing the right flood insurance requires understanding your specific risk factors, coverage needs, and budget. Key considerations include:

- Flood Zone: The Federal Emergency Management Agency (FEMA) maps out flood zones that reflect the likelihood of flooding in a particular area. Homeowners in high-risk zones are required to carry flood insurance by their mortgage lender; however, those in moderate- to low-risk areas should still consider it for added protection as there are many ways a property can flood that are not considered by the FEMA maps.

- Coverage Amount: Evaluate the amount it would cost to rebuild your home value and the cost of your personal belongings to determine the amount of coverage you need. Private flood insurance often offers higher limits, which can be crucial for high-value properties.

- Additional Coverages: Look for policies that offer more than just structural protection. Private insurers often include coverage for temporary living expenses if your home becomes uninhabitable due to flooding.

Get a Quote Today

Flood insurance is a smart investment that helps protect your home from one of nature’s most unpredictable threats. Whether you're required to have it or you're seeking additional peace of mind, talk to a licensed HomeFront agent about your flood insurance options.

Our team is here to help you find coverage that works for you.